Your basket is currently empty!

Autonomous Car Regulations Level 3 – 4, Automotive Cyber Security, V2X & AI

Number of pages: 100 Number of tables and graphs: 50 (32+18) Word count: 40,000 Interview with CTO and co-founder of Autotalks on V2X regulation Format: PDF ALL PICTURES SHOWN ARE FOR ILLUSTRATION PURPOSES PRODUCT MAY VARY DUE TO PRODUCT ENHANCEMENT

Questions? We’re here to help! Request a free personalized video presentation of this report.

Autonomous Car Regulations to transition to Autonomous, Secure and Connected Cars

Read this report to learn about

- The status of the regulatory landscape for the transition from Supervised to Conditionally & Fully-Unsupervised-Driving (SAE Level 3-5).

- The mandatory features of Active Safety, regulations for V2X, and ethical AI.

- Roadmaps and timelines of regulatory mandates and policies in Europe, the USA, China, Japan, the UK and other geographies

- The impact of regulation on market competition and technology adoption.

In this report, we define Autonomous Driving regulation or Autonomous Car regulations as the regulatory and legal developments regarding the transition from a ‘’driver-centric’’ regulation, which includes

- the “assistive” or “Supervised” ADAS / SAE Level 0-2,

- to “Conditionally” (SAE Level 3)

- & “Completely-Unsupervised” driving (Level 4-5) with or without driver controls, which are in the epicentre of regulatory developments because they will allow (limited to specific use cases or full) hands-off the steering wheel, eyes-off and eventually brain-off.

- In addition to approval and homologations, this framework also includes the transfer of liability from the driver to the ADS as well as issues around Automotive Cyber Security and V2V-V2I.

The lack of a harmonized regulatory framework for Level 4-Automated Driving restricts deployment

The lack of harmonization of Autonomous car regulations across major car markets remains the key roadblock to the deployment of L3-4 autonomous driving.

Carmakers and developers of autonomous driving technology face compliance regulatory requirements that are different across major car markets. For example, for countries such as Japan, China, and the EU members that are signatories of the UNECE regulation, there is no framework for type approval of Level 4.

- Germany, was one of the first countries globally to allow testing of L4 but this applies to robotaxis and autonomous shuttles, not private car ownership.

- On the other hand, the U.S. follows self-certification with relevant FMVSS & voluntary guidelines for L4 testing and deployment but there is no federal regulation in place.

- In Apr’22, Japan revised its traffic rules for Level 4 autonomy with enforcement from May 2023.

SAE Lv.4-Full automation describes the scenario where drivers can completely hand over vehicle control and monitoring to the Automated Driving System for specific driving scenarios under the Operational Design Domain of the systems, e.g. Lv.4-Parking Valet parking or L4.-Driving Cruising Chauffeur.

Until today, the only vehicles allowed to operate in Lv.4 Autonomous Driving are robotaxis from Waymo and others. In private car ownership, the highest level of autonomous driving available in the market is Level 3-Conditional Automation.

Regulatory amendment in UNECE finally allowed Level 3-Autonomy in 2021

After almost 3 years in the making, the amendment of UNECE Reg. No.79-Steering Equipment allows Level 3 in countries adopting the new rules called “Automated Lane Keeping System”.

The ALKS regulation applies to 60 countries including the UK, Japan, and EU member states since January 2021, to enable the safe introduction of ‘Level 3’ automation features in certain traffic environments.

UN regulations manage pre-sale Type Approval, i.e. setting out clear performance-based requirements for car manufacturers before ALKS-equipped vehicles can be sold within countries ratifying the autonomous car regulations.

“UNECE’s Automated Lane Keeping System regulation is applicable for LEVEL 3, for low-speed (60 km/h) highway-only”

Global deployment of Level 3 is still fragmented

We see Europe and Japan benefiting from the changes in Autonomous car regulations due to the combination of technological capabilities in Level 3 from their domestic carmakers and the favourable political framework to remove roadblocks and establish their respective markets as key innovation hubs.

Finally, the world’s largest car market in terms of sales, China, released April 2019, national regulations on road tests for Autonomous Vehicles as a part of a broader drive to excel in the development of the technology and gain an advantage in the commercialization of autonomous driving technology. This comes after China halted Autonomous Vehicle trials on public roads until relevant standards for Intelligent Connected Vehicles (ICVs) come into force.

Challenges in the amendment of Autonomous Car Regulations

The transition from driver-centric regulation to Automated Driving Systems will allow the shift from Supervised driving to Conditionally (Lv3) & Completely-Unsupervised driving

Admissibility of automated driving functions depends on the driving and monitoring tasks, i.e. driver engagement, which can be derived based on the level of vehicle automation (SAE J3016 or BASt).

2016-17 saw a shift in the focus of regulation from approving pilots and testing of technologies falling under SAE Level 3/4 to discussion for amendments or event action to enable deployment of Level 3 on public roads. The most evident example was the amendment of the German Road Traffic Act which allows Level 3 from Sep’17, once these systems are type-approved by UNECE regulations.

- As automotive and technology players race to develop and deploy higher vehicle autonomy to unlock enhanced safety in passenger cars and commercial vehicles, new revenues (pricing models of Lv.4, AMoD) and USPs, the slow amendment progress of regulation and the lack of harmonization create barriers for their commercialisation strategies

- Autonomous car regulations need to transition from driver-centric to Automated Driving Systems (ADS) to allow today’s Supervised driving (SAE Level 0-2) to shift to Conditionally (SAE Lv3) & Completely-Unsupervised driving; (Lv.4-5). But lack of regulatory standardization across major car markets will create regional hubs (aka “islands”, such as cities where technology is allowed) and require design variation from OEMs

- The vehicle automation mix is changing with the proliferation of Lv2 driving features. In 2020, Euro NCAP released the ratings of 10 Lv.2 / Highway Assist systems marking Audi’s Q8, BMW 3, and GLE as “Very Good”.

- With the introduction of Lv.3 allowing Conditionally-Unsupervised driving and vehicles with different levels of autonomy co-existing on the road, clear safety requirements are needed in the form of standardized, international Autonomous car regulations which could mitigate scepticism of higher vehicle autonomy.

We expect Autonomous car regulations to accelerate as key car markets boost their efforts to lead the global Autonomous Vehicle scene -but also guarantee safe and secure deployment.

Level-1 Active Safety Regulations will push ADAS penetration & passenger monitoring

Upcoming regulatory & market requirements push for the expansion of monitoring from drivers to occupants & drive holistic cabin sensing

Since mid-2022, all motor vehicles (incl. trucks, buses, vans and sport utility vehicles) in the EU must be equipped with Driver Monitoring Systems to mitigate drowsiness and distraction.

The regulations will apply 30 months after entry into force with a longer application date provided for a limited number of features in order to allow OEMs to adapt their production to the new requirements.

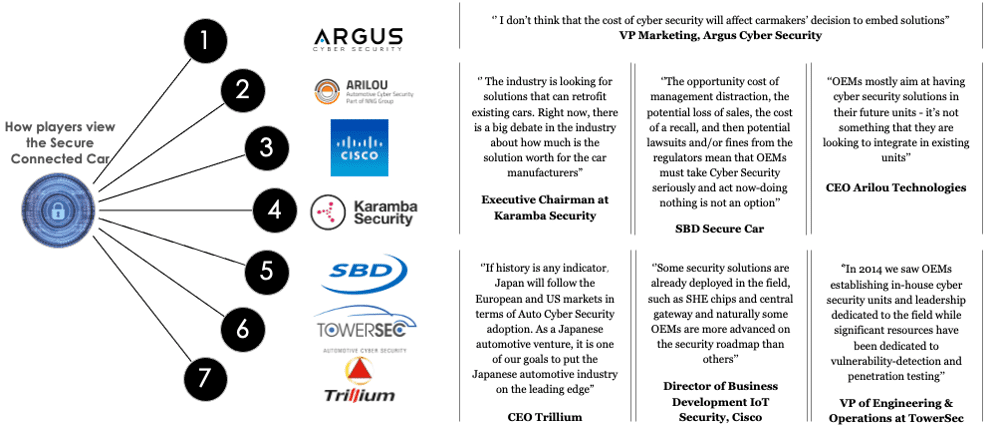

Automotive Cyber Security becomes mandatory

Over the next decade, as transportation progresses from Connected and Partially-Automated to Highly and Fully-automated, Smart and Shared Mobility, the addition of new sensors and ECUs, new architecture, more Connected devices and V2X will significantly enlarge the vehicle ‘’attack surface”.

Identifying, mitigating and responding to cyber threats will not only be paramount for physical road and vehicle safety but also a prerequisite for the transition towards self-driving cars.

Autonomous car regulations such as the ALKS R157 will also need to comply with cyber-security and software update requirements set out in two other new U.N. regulations. In more detail, two new regulations on automotive cybersecurity and software updates to establish clear performance and audit requirements for OEMs are coming into effect in Jan’21.

The first is the “UN Regulation on Cybersecurity and Cyber Security Management Systems” and the second the “UN Regulation on Software Updates & Software Updates Management Systems”.

Table of Contents

- Executive Summary

- Regulatory amendment in UNECE to ALKS finally allowed Level 3-Autonomy from 2021

- Germany passes Autonomous car regulations for Level 4 to bring robotaxis & autonomous shuttles to market

- The U.S enhances the clarity of AV testing with the expansion of its AV-TEST INITIATIVE

- Automotive Cyber Security is becoming mandatory

- China’s commitment to ICVs could fast-track regulatory changes

- Data Storage to help insurance claims from accidents in L3 automated mode

- Active Safety Regulations will push ADAS penetration and passenger monitoring

- Autonomous Driving Regulation for SAE LEVEL 3 Systems

- Automation “language” barriers confuse drivers about the capabilities of vehicles

- Inherent differences in regulatory process delay harmonisation

- How does regulation affect deployment? Favourable geographies for L3 deployment

- Europe: the amendment of UN R79 to R157 vs a Horizontal regulation

- Germany to lead AD deployment in Europe driven by supportive Autonomous car regulations

- Opportunities for the UK to compete as a global Autonomous Driving hub

- Flexible Autonomous car regulations in the U.S. but concerns over discrepancies among states

- China’s Regulation for Intelligent & Connected Vehicles (ICVs)

- Japan’s Autonomous car Regulations

- Summary of AD regulatory developments in other leading markets

- Active Safety regulation for ADAS L1 & NCAP Lv.2 rating

- The problem with driver distraction, confusion or misuse because of ADAS UX/UI

- UN GSR2 mandates Active Safety equipment to tackle distraction

- EuroNCAP’s 2024 rating of Highway Assist / SAE Lv.2 features

- Data recording & liability in L3-Conditional automation

- Learn why need Automated Driving-Event Data Recorders

- Regulatory guidance on data recording & storage for L3

- Three drivers for Data-based business models

- L3 automation presents challenges & opportunities for the insurance value chain

- Automotive Cybersecurity Regulation in the major car markets

- The new regulations will push for the adoption and standardisation of Auto Cyber Security

- UN Regulation on Auto Cybersecurity: EU & Japan

- Two new UN Regulations on Software Updates & their Management Systems

- ISO/SAE 21434: a joint standard to harmonise Auto Cyber Security

- Automotive Cyber Security Regulatory Action in the USA

- What regulatory/legal action is needed to secure Connected Cars?

- Cyber Security for V2X Communications

- V2X – Vehicle to Everything (V2V, V2I) regulation

- How could V2V and V2I communications help towards road safety?

- V2V isn’t a technical prerequisite for HAVs but can enhance safety

- Comparison of the V2X tech: DSRC 802.11P vs. C-V2X

- State of the art: V2V & V2I are already on the road today

- V2V-V2I regulatory roadmap: UN, USA and China

- Security and privacy in DSRC-based V2V and V2I

- Insights on the regulatory activity for V2X with CTO of Autotalks

- Regulation for Artificial Intelligence in Automotive

- European Commission’s first attempt to regulate “high risk” AI

- Ethics Regulations for AI: BMW Group & Continental