Your basket is currently empty!

Advanced Driver Assistance System: Market Growth and Opportunities

We are here to help! Contact us for custom research or automotive technology databases.

Posted by:

Published:

Advanced Driver Assistance System Market

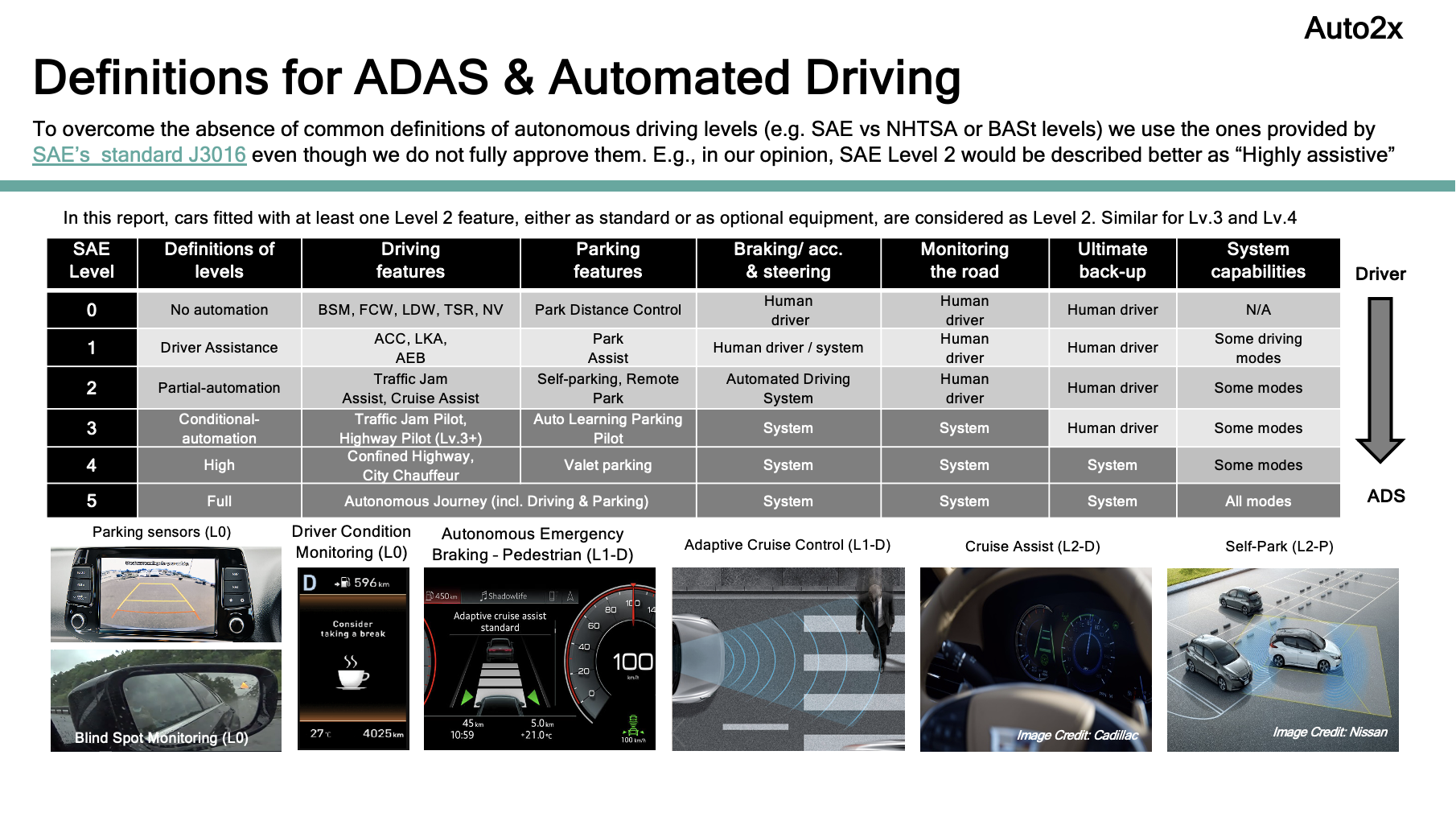

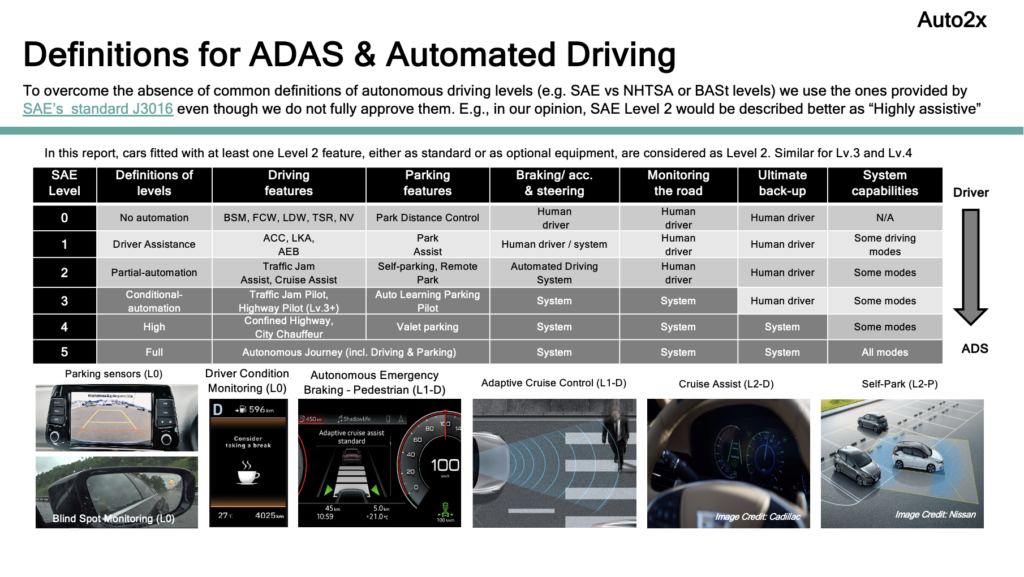

The advanced driver assistance system (ADAS) market is on a trajectory of unprecedented growth, with revenues expected to surpass €35 billion by 20251. This surge is driven by increasing demand for sensor content (e.g. radars, cameras, Lidar) required for Level 2-3 features and the development of Level 4 autonomous driving capabilities.

As the automotive industry pivots toward higher levels of automation, advanced driver assistance system suppliers stand poised to capitalise on emerging opportunities in sensors, AI, software stack and computing technologies.

ADAS revenues have more than doubled since 2021, showcasing the market’s dynamic evolution. This remarkable growth is largely attributed to:

- Sensor Innovations: Modern vehicles require advanced sensors such as forward-looking and side radars (e.g. 77GHz, mmwave), cameras (mono, stereo), lidar (solid state), and ultrasonics to enable features like Adaptive cruise control (ACC), parking assistance, and highway autonomy.

- Level 2-4 Automation: The shift from basic driving aids to advanced automation systems is fueling demand for high-performance hardware and software.

- Collaborations and Partnerships: OEMs and tier-1 suppliers are forming strategic alliances to accelerate the development of scalable AD platforms, AD Software Stacks and AI-driven capabilities.

Advanced Driver Assistance System Suppliers

The ADAS market is highly competitive, with established giants and newcomers vying for dominance.

Bosch, Continental, ZF, and Valeo, the top European ADAS suppliers, have consistently driven innovation and captured significant market share.

Top Performers and Revenue Growth

- Bosch, the world’s biggest automotive supplier with €91.6 Billion in 2023, develops ADAS in the Mobility Solutions business segment. Even though the company does not report sales of ADAS, their revenues from radars and camera systems exceed 2 billion euros.

- ZF achieved 11% growth in ADAS revenues in 2023, with sales reaching €2.7 Billion, up from €2.4 billion in 2022.2

- Continental saw a 23% boost in 2022 ADAS revenues, reaching €2.1 billion and accounting for 11% of its automotive revenue3.

Among other non-European suppliers, Mobileye, a leading suppliers in the ADAS camera market with their EyeQ SoC, achieved sales of $2.1 Billion in 2023.

Emerging Players

Global suppliers such as Bosch, Continental, APTIV, Denso, Valeo, ZF, Mobileye, Magna, Hyundai Mobis dominate the market for advanced driver assistance systems.

However, there are several opportunities for new entrants to disrupt the existing supply chain in

- Next-gen Perception Hardware for Autonomous Driving;

- Autonomous driving software, e.g. AD SW Stack for L2-4;

- Computing, e.g. for Peta-ops chips for Autonomous Driving;

- AI for Autonomy, such as Generative AI and LLMs or HMI such as in-car AI assistants;

- Data-based Business models such as in-car e-commerce;

- 5G-6G, Connected Infrastructure and Smart Cities;

- Autonomous Shared Mobility and autonomous deliveries.

Chinese companies like Baidu and Huawei are gaining momentum by integrating advanced technologies such as lidar and AI solutions into their solutions across domestic and international markets.

Helm.ai, Haomo, Zenseact, Hitachi, Qualcomm emerge as serious contenders.

Lenovo entered the ADAS-DC (Domain Controller) market as Tier-1 supplier partnerting with NVIDIA.

Opportunities in Advanced Driver Assistance Systems

Sensor Market Boom

ADAS sensors represent the lion’s share of revenue, with innovations in radar, lidar, and cameras driving significant growth. For example:

- Bosch’s Supercomputers: Bosch secured €2.5 billion in vehicle supercomputer orders, highlighting the importance of processing power in autonomous systems.

- Continental’s Innovations: The company introduced AI-based object detection, enhancing its market position.

- Mobileye is launching Imaging radar in 2025, to expand its sensor portfolio beyond camera-based ADAS (EyeQ) to attract revenues from existing and new clients, while also getting closer to redundancy for L3-4 Autonomy.

Growth in Autonomous Driving Features

By 2025, the ADAS market will be defined by increased adoption of Level 2/2+ features, expansion of Level 3 and the introduction of Level 4 systems in autonomous trucks. Key features include:

- Enhanced redundancy systems, such as redundant computing and data storage

- Driver-facing cameras.

- Centralized electronic architectures.

- Autonomous driving software stacks

Regional and Global Market Expansion

In 2022, 42 Level 3-capable models were launched in Europe, a number expected to rise as regulatory hurdles are addressed.

The US and China are also key markets, with rapid adoption of automation technologies.

India is a promising market for Level 2 ADAS.

Challenges for Advanced Driver Assistance System Suppliers

Despite opportunities, ADAS suppliers face challenges such as:

- Intense competition from new entrants like Qualcomm and Microsoft.

- The transition from hardware-centric to software-driven business models.

- Meeting regulatory requirements across diverse markets.

Why Choose Auto2x’s ADAS Report?

Our report on Advanced Driver Assistance System provides:

- Access to a live dashboard to monitor players and technologies in real-time;

- Comprehensive rankings of major suppliers by revenue, sensor types, and geographies;

- Competitive benchmarking and strategy assessments for key players like Bosch, Continental, and Mobileye;

- Detailed forecasts for the 2025-2030 period;

- Insights into suppliers’ capabilities in radar, lidar, and AI integration.

Unlock the Future of ADAS

Don’t miss out on understanding the trends and technologies shaping the future of driving. Purchase our report to gain access to critical insights and stay ahead in the competitive ADAS market.

References

- Auto2x ADAS Market Analysis 2023 ↩︎

- ZF, Annual Report 2023 ↩︎

- Continental, FY 2022 Results ↩︎

Questions? We’re here to help! Contact us for custom research or automotive technology databases.

Want to Track the Latest Trends in Automotive?

- Discover 200+ opportunities,

- Explore 2000+ technologies,

- Connect with 3000+ companies.

Product Search

Use this search box to quickly find the most relevant products.

About us

Auto2x is a London-based market research firm specializing in the automotive sector. We deliver in-depth insights and analysis on industry trends, emerging technologies, and market dynamics, helping businesses stay ahead in the evolving automotive landscape.

Want to Track the Latest Trends?

- Discover 200+ opportunities,

- Explore 2000+ technologies,

- Connect with 3000+ companies.