Your basket is currently empty!

ADAS Supplier Readiness for Level 4 Autonomy: Sensors, Systems, Strategy, Market Shares

The rankings cover APTIV, Bosch, Continental, Denso, Magna, Mobileye, Valeo, ZF, Baidu, Alibaba, Amazon, Huawei, and others. Learn about their technological capabilities, understand the strategies, and get insights on who is better positioned in the marketplace. Format: 100 pages. Optional upgrade: Live database of scoring and rankings of 20+ Tier-1 ADAS suppliers.

Questions? We’re here to help! Request a free personalized video presentation of this report.

Key Findings: ADAS Suppliers Readiness in Level 4 Autonomous Driving?

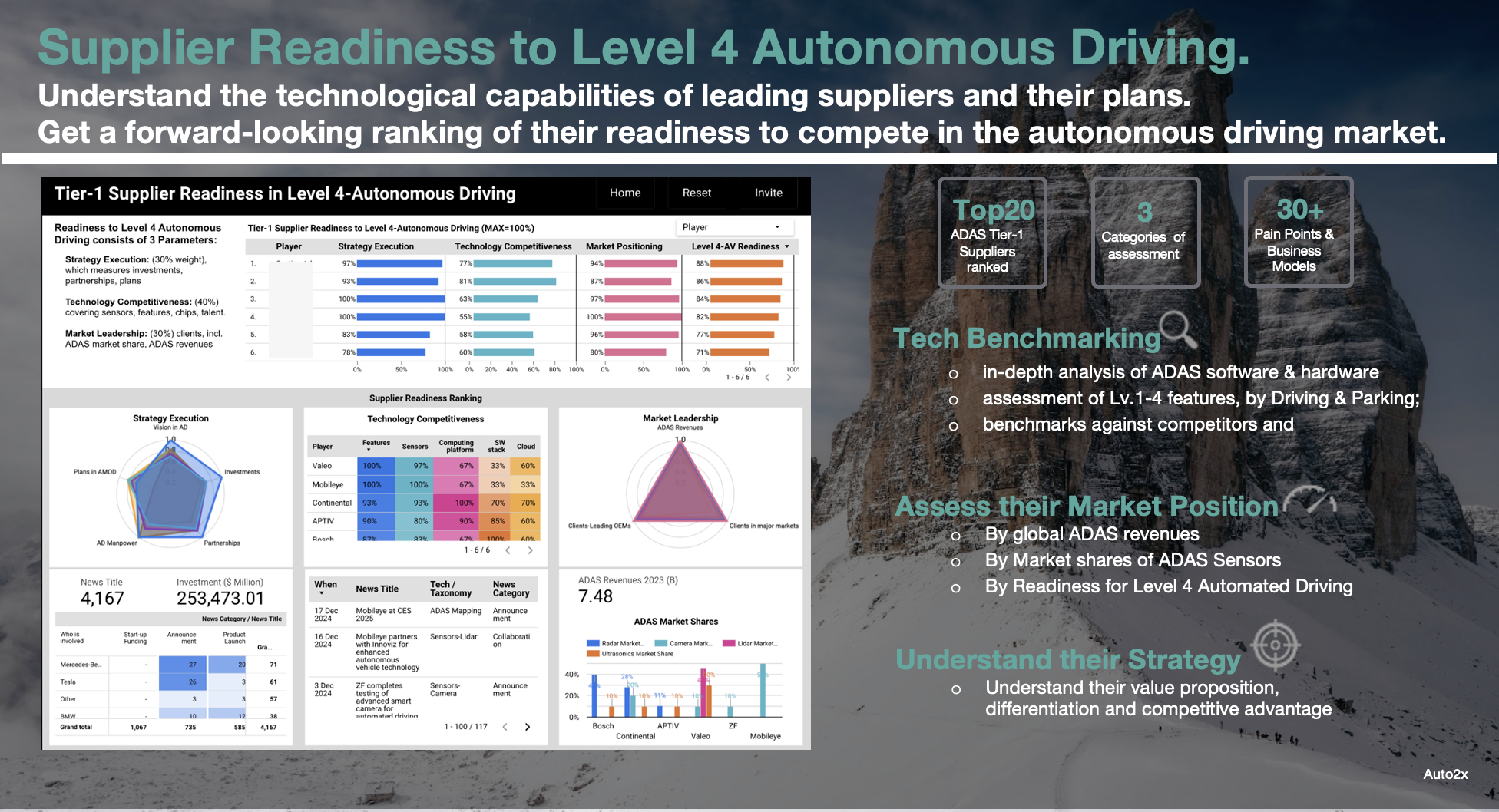

Auto2x has released its “Supplier Readiness in Level 4 Autonomous Driving Rankings” report, offering insights into the evolution of the competitive landscape of Advanced Driver Assistance Systems (ADAS) and the roadmaps to Level 4 autonomous driving from technology providers.

The rankings cover the Top-20 ADAS Tier-1s, including APTIV, Bosch, Continental, Denso, Mobileye, Valeo, and ZF, in addition to Baidu, Alibaba, Amazon, Huawei, Foxconn and others.

To assess Supplier Readiness we quantify 3 parameters:

- the technological capabilities of suppliers in sensors (radar, cameras, lidar, ultrasonics), features (Level 1-4 Cruising and Parking), computing (AD Domain Controllers) and software (ADAS Perception Software Stack).

- their strategies, including partnerships, investments, M&A, new product launches, supply chain and business models.

- how they are positioned in the marketplace, their revenues from ADAS, their client base and regional expansion.

Key findings

- Incumbent Tier-1 suppliers lead the ADAS market, but they face challenges to transform and fight the competition.

- Emerging Chinese Suppliers and tech entrants threaten the leadership of major Tier-1s in ADAS & Electrification.

- New opportunities in perception, computing, AI (Generative AI for vision-based Level 4), SDVs and new markets.

- Suppliers should continue investing in tech, strengthen partnerships and build customer-centric business models.

How Readers Will Benefit By Reading This Report

Who Should Read this Report

- Engineering, Strategy, Marketing, R&D and Innovation functions in Automotive OEMs and Tier 1-2 Suppliers

- Innovation Managers in Technology companies exploring automotive market entry

- Investors and financial analysts focused on the automotive sector

- Automotive industry consultants and strategists

How Readers Will Benefit

- Gain a comprehensive understanding of the ADAS supplier landscape

- Identify partners or acquisition targets for autonomous driving technology

- Assess competition from both established players and new entrants

- Guide strategic decisions around R&D investments and market positioning

- Understand emerging trends and technologies shaping the future of autonomous driving

Methodology & Why does a Readiness Level matter

To succeed in the Autonomous Driving race suppliers must be competitive across 3 parameters:

- technological competitiveness,

- good strategy execution (strong network of partnerships and investments), and

- strong market positioning to capture market share.

Strategy

- Foresee changing market needs amid volatility by investing in the right tech, market at the right time.

- Identify new revenue pools from innovation, and market consolidation, such as shift of revenue pools in Asia.

- Strategy execution includes a powerful vision, partnerships, investments and M&A

Future-proof Technology

- Next-gen SW-HW needed for Level 3/4 autonomy e.g., DC, compute, 4D imaging radar. Who has an edge?

- Autonomous Driving Perception Software offerings from top suppliers.

- New cruising and parking features emerge: Who is innovating to offer competitive solutions?

- Technological competitiveness includes: a strong portfolio of Level 1-4 features for private cars, autonomous trucks, shared mobility and other use cases (Level 4 features, such as Highway Chauffeur, City and Valet Parking are in development); a comprehensive and robust set of sensors (e.g. imaging radar, solid-state lidar); capabilities in centralised E/E Architecture, SW Stack, Validation-Verification and others.

Market Leadership

- Adapt to changing needs and emerging markets to build new revenues or maintain.

- Leaders are threatened by new entrants such as Tech Giants with AI, Cloud or in-house

- This parameter captures:

- Number of clients in ADAS sensors and features, incl. Carmakers, Trucks, AMOD

- Clients in Top-4 major markets: China, USA, EU, Japan

- ADAS revenues

- Market shares in sensors, features and regional

- ADAS-to-Sales ratio to show their focus on AD

Which suppliers are better prepared for the New Era of Autonomous Mobility?

Incumbent Tier-1 suppliers lead the ADAS market

Auto2x assessed the readiness levels of major Tier-1 suppliers and emerging players based on their technological competitiveness, their strategy execution and their market positioning.

The first parameter, Technology Competitiveness, captures the product portfolio of sensors, features, architecture, software stack and innovation (patents).

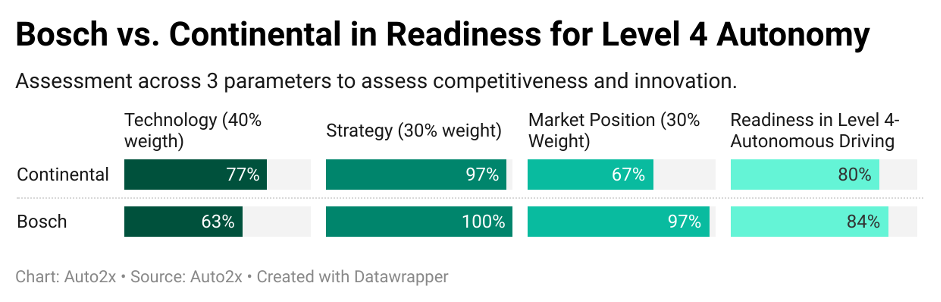

- Auto2x assesses that APTIV and Continental have high readiness levels in Level 4 Autonomous Driving Technology due to their mature offering in Lidar, AD Software stack and Computing Platforms.

- Baidu offers competitive technology due to Apollo’s strengths.

Strategy Execution, the 2nd parameter, covers a supplier’s partnerships, investments, ADAS manpower, activities in autonomous mobility and more.

- Bosch and Mobileye lead the pack in this parameter, with strong in-house capabilities, a partner ecosystem in high-growth areas and investments in key markets.

- Continental is a 100% system supplier from design and manufacturing to validation and expansion to new services in system integration and functions. This makes them well-positioned.

Market Positioning, the 3rd parameter, captures the volume of ADAS revenues from sensors and features, sensor market share, client base and geographical presence.

- Major Automotive Tier-1 Suppliers like Bosch, ZF, Valeo, Denso and Continental still maintain the lion’s share in terms of automotive revenues. But they were overtaken by Bosch in 2019, who leads the market by ADAS revenues since then.

- The contracts with OEMs for ADAS and the ability to support driving and parking features for higher levels of automation are strengths.

Overall Readiness Level: The Ranking of Suppliers Readiness in Level 4 Autonomous Driving is based on their competence in three parameters, Strategy (30% weight), Technology (40%) and Market Position (30%).

- Auto2x found that Bosch leads the ADAS market by revenues from sensors for Level 1-2 features, but they lag in Technology Readiness for Level 4 Autonomous Driving.

- Another success story is Mobileye which spearheads INTEL’s Autonomous Driving strategy and has captured a large share in ADAS. Mobileye ranks at the Top-3 of Auto2x’s Ranking of Suppliers by Readiness in level-4 Automated Driving.

European suppliers lead the race but Chinese Suppliers are catching up

ZF and Continental broke the €2 Billion mark in ADAS revenues, but challenges remain.

The Top-4 Automotive Suppliers of ADAS are all European, Bosch, Valeo, ZF and Continental, according to Global ADAS Ranking by Revenues. The 4% growth in automotive production in 2022 and the higher sensor fitment for Level 2-3 systems benefited their ADAS sales and Order Books.

- ZF achieved 33% growth in ADAS revenues in 2022 to €2.4 Billion, from €1.8B in 2021. ZF ranked 3rd in the Global ADAS Ranking by Revenues in 2021 from Auto2x with an 11% market share.

- Continental saw 23% growth in ADAS sales to €2.1 Billion in 2022, from €1.7B in 2021. ADAS accounted for 11% of Continental’s Automotive revenues.

But major automotive suppliers face further transformation to develop capabilities in AI and software, expand into software business models and face new competition.

New Opportunities in Autonomous Driving

The Battlefront in Autonomous Driving Software

Electrification, automated driving, shared mobility and connectivity push for more dedicated software development. A large part of hardware-oriented systems becomes more standardized and commoditized.

The growing number of ECUs with sophisticated software leads to significant cost increases, higher in-vehicle software complexity and constraints in optimising vehicular functions.

Next-generation Digital vehicles must integrate new, diverse technologies and complex logical operations; the hardware architecture has to support advanced software functionality and upgradability.

New partnerships and new business models are emerging.

What are some key new Software-driven features with high potential?

Software is the answer to the Digitization of the Automotive Industry but delivery is challenging.

Learn about top innovation clusters across major technological building blocks of SDVs.

• Autonomous Driving Software Stack: Perception Software (vision, radar, HD maps, sensor fusion), Driving and Parking features.

• Next-generation sensors: Imaging radars, satellite cameras, etc/

• EE Architectures: Assess the roadmaps of leading carmakers and suppliers in the development of centralized architectures and their partnerships;

- Aptiv’s Active Safety Domain Controller integrated by BMW;

- Visteon’s Domain Controller SmartCore, launched by Mercedes Benz;

- zone-oriented control units (ZCUs), where the vehicle is divided into zones and each zone integrates into a zone-ECU (the sub-ECUs do not perform any processing to realize a vehicle function) e.g. Bosch’s zone-oriented E/E architecture;

- cross-domain centralized units (CDCUs), where the functions of more than one domain are consolidated onto a single ECU (similar to the DCU’s architecture) e.g. Bosch’s vehicle-centralized ECU.

• CarOS: Learn about the rising adoption of Google’s Android Automotive OS and the competitive offerings from MBUX and other players;

• Open-source software development

• Cloud: the emergence of automotive cloud as an enabler for cloud-based ADAS development, development of offerings from carmakers and the role of Microsoft, Amazon among others;

• Over-the-Air-updates and the opportunities for features-on-demand;

• Digital Twin

How could innovation in AI and cloud computing impact autonomous driving?

New technologies like AI and cloud computing are crucial for the future of autonomous driving as they enable advanced data processing, real-time decision-making, and scalable software updates.

AI enhances vehicle perception and autonomy through machine learning and in-car assistants, while cloud computing supports efficient feature development and system integration.

Together, they facilitate the transition to higher levels of automation and improve overall vehicle performance and safety.

The integration of AI and cloud computing will change the consumer experience in autonomous vehicles

Integrating AI and cloud computing will significantly enhance the consumer experience in autonomous vehicles by enabling personalized in-car services, such as tailored entertainment and real-time navigation assistance.

Cloud computing allows for continuous updates and feature enhancements, ensuring vehicles remain up-to-date with the latest technology and safety features.

Additionally, AI-powered virtual assistants can provide seamless interaction, improving convenience and overall satisfaction during travel.

Expanding to New Markets and Sectors

Which technologies show potential for them to enter and which countries?

Countries with promising opportunities for new suppliers include China, the USA, and Europe, where demand for autonomous driving solutions is rapidly growing.

What challenges do automotive companies face in achieving Level 4 autonomy?

Automotive companies face several challenges in achieving Level 4 autonomy, including the need for advanced sensor technology and high-performance computing platforms to process vast amounts of data in real time.

Regulatory hurdles and safety standards must be navigated to ensure compliance and public acceptance of autonomous vehicles.

Significant investments, research and development, and partnerships are required to build the necessary infrastructure and technology ecosystem for successful deployment.

What risks do leading Automotive ADAS Suppliers face?

Suppliers face risks from increased competition, particularly from tech giants and emerging players that leverage AI and cloud technologies, potentially disrupting traditional supply chains.

The transformation of carmakers into mobility service providers pressures suppliers to adapt quickly to software-driven models, which may require significant investment and restructuring.

Additionally, the shift from hardware to software monetization poses challenges for suppliers reliant on traditional revenue streams, necessitating the refinement of their business strategies to remain competitive.

How could new suppliers and Tech Giants disrupt major Tier-1s?

Traditional ADAS suppliers still maintain the lion’s share in automotive supplier revenues. But they face competition from US, Chinese and other Tech giants who capitalize on their expertise in AI, Cloud and Software transforming automotive.

In the 2020s the vehicle’s software value will exceed that of hardware as carmakers shift to more common platforms to achieve cost savings and existing players are forced to move away from vertically integrated, asset-heavy business models to compete with new entrants.

Software will be crucial for product differentiation such as new features, content, and new personalized experiences.

We have identified several opportunities for Tech Companies to enter or disrupt the existing supply chain.

• Next-gen Perception Hardware for Autonomous Driving

• Computing, e.g. Peta-ops chips for Autonomous Driving

The computing power required for a

– Lv.2 vehicle is 10 TOPS (tera operations per second),

– Lv.4 exceeds 100 TOPS,

– Lv.5 vehicle will require a 1,000 TOPS computing processing power.

• AI: AI for Autonomy and HMI such as in-car AI assistants

• Data-based Business models such as in-car e-commerce

• 5G-6G, Connected Infrastructure and Smart Cities

• Autonomous Shared Mobility and autonomous deliveries

How can Suppliers stay competitive and gain competitive advantage?

What should suppliers do to stay relevant in autonomous driving, gain competitive advantage and market share?

Suppliers should invest in next-generation technologies, such as advanced perception hardware, AI, cloud computing to meet the evolving demands of autonomous driving.

Another important aspect is building competence in Autonomous Driving software and sensors needed by carmakers to develop higher autonomy.

They should also adapt their strategies to identify new revenue pools and collaborate with innovative partners to tap into high-growth opportunities.

By forming commercial and product development partnerships with volume carmakers to support their connected, electric and ADAS roadmaps. The AI and connectivity domains in the booming Chinese market are crucial for new AD Suppliers to claim market share from global Tier-1s.

Additionally, suppliers must continuously assess competition and enhance their product offerings to maintain a competitive edge in the market.

Finally, fuel investments in innovative technologies and business models incl. robotaxis, and last-mile delivery.

What are some key market entry strategies for new suppliers?

Key market entry strategies for new suppliers include forming strategic partnerships with established players, investing in innovative technologies, and focusing on niche markets within the autonomous driving sector.

Technologies with potential for entry include next-gen perception hardware, AI for autonomy, and advanced computing solutions.

- Lenovo has entered the AD-DC market as a Tier-1 Supplier with partnerships with NVIDIA and Valeo.

- Huawei supplies LIDAR and car networking to BAIC for L2+. Huawei has recently launched new products in Autonomous Driving focusing on ADAS sensors (4D imaging radar), HMI (AR-HUD) during their product launch titled ‘Focused Innovation for Intelligent Vehicles’.

- Samsung Electronics will work together with Tesla to develop chips for their HW 4.0;

Table of Contents

1. Supplier Readiness in Level 4 Autonomous Driving

- Methodology for the Supplier Readiness Level

- Findings from the overall ranking of Readiness in Level 4-AD

- Strategy Execution ranking summary

- Technology Competitiveness ranking

- Market Leadership Ranking Summary

- Opportunities for ADAS-AD Suppliers

- Opportunity Radar: rankings by Act, Prepare, Watch

- Recommendations for incumbents and new market entrants

- Gaps in the portfolios of Tier-1 Suppliers

- Risks that threaten their leadership

2. Strategies and execution

- Trends in Supplier ADAS-AD Strategy

- Supplier roadmaps to Level 4-AD

- R&D of Suppliers to drive AD-SW

- New Product Launches

- Key collaborations

- Strategies in AMOD (Automated-Mobility-on-Demand)

- Suppliers of Level 3-4 Autonomous Driving Platforms

- Investments in Autonomous Driving

- New Business Models: SaaS, CaaS, DaaS, VaaS, Tier-X

- Continental’s Spin-off of the Automotive Segment

- Lenovo’s entry into the AD markets as a new DC Tier-1

- Mobileye’s Imaging Radar

- Valeo’s Brain segment

- Qualcomm

- AI Regulation and Development of Ethics

3. Technology Competitiveness

- Ranking by Technology Competitiveness r

- ADAS L0-L4 Feature Availability across major Tier-1 Suppliers

- Sensor portfolio of leading Tier-1 Suppliers

- ADAS Radar and Camera benchmarking

- Next-generation radars, camera, lidar

- Driver and passenger / occupant monitoring (DMS-OMS-PMS)

- Rise of on-board vehicle Computing

- Data recording for Level 3-4 Autonomous Driving

- The evolution of E/E Architecture for connected and automated driving

- Innovation in Software-Defined Vehicles (SDV)

- Low-No Code solutions in ADAS and autonomy

- Innovators in Patents, Intellectual Property and Scientific Literature

- Future of ADAS features from Auto2x AD Radar

- Generative AI and new applications in Autonomous Driving

- Vehicle-to-Everything Communications (V2V, V2I, V2X)

3. Market Leadership and Positioning

- Supplier Rankings by Automotive Revenue

- Supplier Revenues by ADAS-Software divisions

- Ranking of Suppliers by ADAS Revenues

- Supplier market shares in 77GHz radar

- China’s strengths to become Top AD Hub

- Rise of Level 2-ADAS in India

5. Opportunities in ADAS and Autonomous Driving for Suppliers

- Rising ADAS sensor content

- Sensor Forecast and TAM

- Forecast of revenues from Lidar for L3/L4

- Rising demand for SW for ADAS

- (SDV) Software-Defined Vehicles

- Subscriptions for ADAS

- AMOD (Automated-Mobility-on-Demand)

- Regulation for Level 3-4

- CarMetaverse

- Autonomous Deliveries

- Insurance for Level 3-4 Automated Driving

- Autonomous mining

Companies Mentioned

- Alibaba

- APTIV

- Amazon

- Bosch

- Baidu

- Continental

- Denso

- Forvia

- Hella

- Hitach AS

- Hyundai Mobis

- Huawei

- LG

- Lenovo

- Magna

- Mando HL

- Mitsubishi Electric

- Microsoft

- Intel-Mobileye

- NVIDIA

- Qualcomm

- Samsung-Harman

- Valeo

- Visteon

- Veoneer

- Zenseact

- ZF